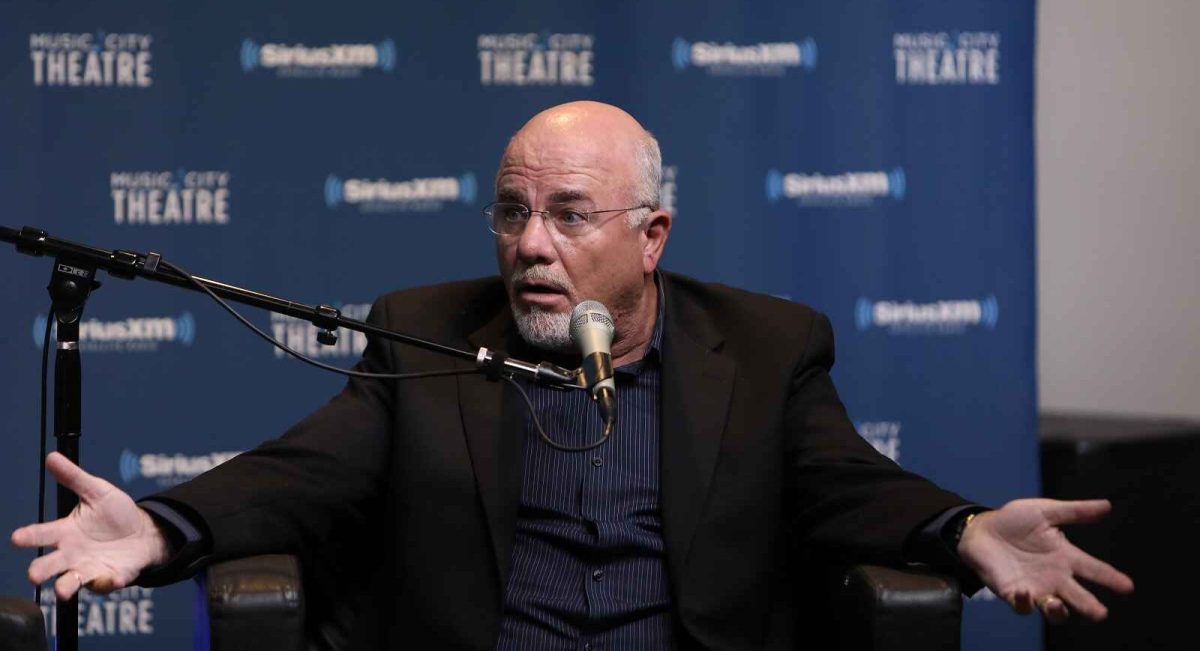

And although it may seem counterintuitive, Dave Ramsey hates car payments even if you’re loaded. The popular radio host and financial guru is known for his no-nonsense approach to personal finance, and one of his key principles is to avoid debt at all costs.

Ramsey believes that car payments are a drain on your financial resources, even if you have the money to easily afford them. He argues that car payments tie up money that could be better used for other things, such as investing, saving for retirement, or building an emergency fund. By committing to a car payment, Ramsey contends that you are limiting your financial freedom and putting yourself at risk in case of an economic downturn or personal crisis.

Ramsey also points out that car payments typically come with high interest rates, which means that you end up paying more for the vehicle than it is actually worth. This can lead to a cycle of debt that is difficult to break free from, especially if you continue to trade in for newer and more expensive cars every few years.

So what does Ramsey suggest instead? He advocates for paying cash for a car or saving up enough money to buy one outright. This may mean driving a cheaper or older vehicle for a while, but Ramsey argues that the short-term sacrifice is worth the long-term financial stability and freedom that comes with not having a car payment.

For those who insist on having a new car, Ramsey recommends buying a reliable used vehicle that is a few years old. This allows you to avoid the steep depreciation that comes with buying a brand-new car while still getting a reliable vehicle that meets your needs.

Ramsey’s stance on car payments may seem extreme to some, especially in a culture where buying new cars and financing them is the norm. However, his message resonates with many who have experienced the burden of debt and want to take control of their financial future.

In the end, Ramsey’s advice is simple yet powerful: avoid debt, live below your means, and prioritize financial security and freedom. By following these principles, you can avoid the pitfalls of car payments and build a strong financial foundation for the future. So, even if you’re loaded, it’s worth considering Ramsey’s advice on car payments and how it can impact your overall financial well-being.